The Coronavirus crisis will be one of the defining economic events of the 21st century. Already, countries have suffered unprecedented spikes in unemployment, many blue-chip businesses have reported substantial losses, and governments have pledged record stimulus measures to soften the impact of the global pandemic.

Under this daily barrage of bad news, it’s no surprise that most Australians are worried about the state of their finances. So how can you navigate the noise, focus on what matters and protect your wealth for the future?

In this note, we break down our current analysis of the crisis and offer insights into how you can maintain a level-headed and strategic approach to weathering the storm.

Navigating COVID-19 Market Volatility: Think Like an Investor, Not a Trader

February 2020 began with the ASX 200 at record highs; reaching beyond 7,000 for the first time and eclipsing its pre-GFC highs. One month later, the market had shed over 36%; plunging to just over 4,500 in a frantic sell-off, the speed of which hasn’t been seen since the late 1980s. These falls and subsequent massive intraday swings have reflected the Volatility Index, which has spiked to levels not seen since the GFC.

In any market crisis, two camps of investors emerge. On one hand, there are the people scrambling for the eject button, hoping they can move to cash before the market reaches the bottom. On the other, there are the longer-term investors sticking to their guns, saying “you only lose when you sell.” Which is the right approach?

It’s near-impossible to time the market and attempts to do so often damage the long-term health of your portfolio. Allowing fear and panic to hijack your judgement might calm your nerves in the short term, but undo the years of disciplined decision making that have grown your portfolio.

For example, investors who were able to stay the course through the GFC may have realised immense gains until now, and regard this current crisis as just another ‘blip’ on the radar. While it’s unnerving and unsettling to see your portfolio retract significantly, ask yourself this: are you an investor or a trader? Stay calm and consider the long game - in times of crisis, opportunities abound.

We may feel scared by what is happening around us at the moment, but remember, your goals are long term and there will be many ups and downs.

Credit: Carl Richards

V or U-Shaped Recovery?

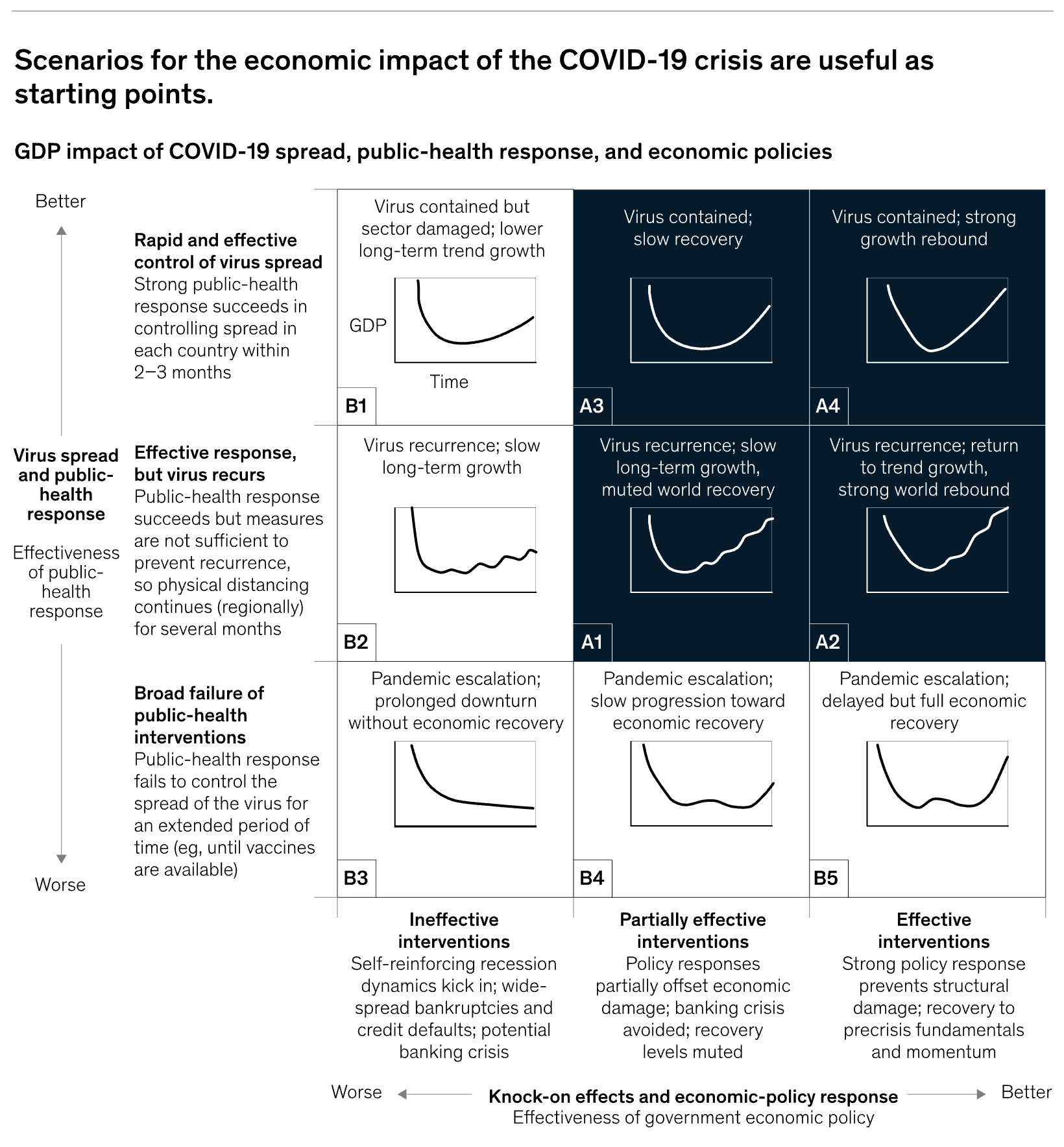

Since this crisis began, financial analysts have been debating whether this will be a ‘V-shaped’ or ‘U-shaped’ economic recovery. In a V-shaped model, markets recover quickly, resembling a V. In a U-shaped model, markets dwell at lows for a longer period of time before starting their recovery, resembling a U.

Unfortunately, this is unlikely to be a V-shaped recovery, and many areas of our economy will bear the scars of COVID-19 for years to come. Even once a vaccine is developed, tested and administered, the recovery is unlikely to be rapid, although excited gains on sharemarkets can be expected as positive headlines emerge.

What is a more realistic picture of the economic recovery than a U-shaped return to normal? McKinsey offer nine models that account for factors including virus response, containment, and policy success:

At this stage of the crisis, an A1 or A2 scenario as seen in the above graphic could be positive and realistic economic outcomes. The Australian Government’s social response has thus far been successful in curbing an uncontained viral outbreak. Likewise, their swift and comprehensive financial response has softened the blow for many Australian businesses, with positive stimulus measures like the JobKeeper Payment to minimise redundancies.

Again, the future of the Coronavirus crisis is unknown, and the long-lasting impacts on our economy are only conjectured at this early stage of the pandemic. However, with Australian unemployment likely to reach 10% and a global recession becoming more likely, none of us should bank on a rapid recovery to “pre-COVID” levels. However, we can take some comfort in the unprecedented response that the Australian Government has demonstrated thus far.

How to Exercise Wealth Crisis Management During COVID-19

It may feel impossible to plan for the future in this uncertain climate, and indeed, nobody can reasonably predict the events of the coming months. However, there are proactive steps you can take to keep emotion out of your decision making and protect your wealth.

1. Live Up To Your Risk Tolerance

Many investors like to believe they’re highly tolerable to risk, and can easily bear the emotional strain of a significant downturn. However, when push comes to shove and their portfolio retracts by 20 or 30%, they follow the masses and jump ship.

If you fall into this category, remind yourself of the risk you accepted and planned for when you began investing.

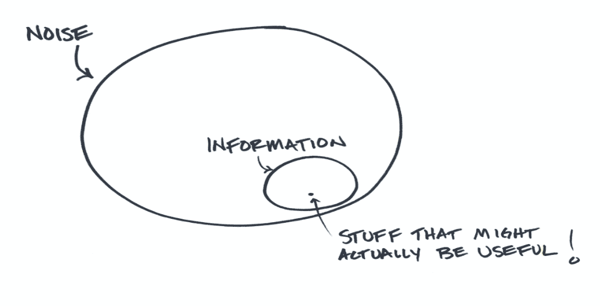

2. Shut Out The Noise

If you’re tuning into Futures each morning, following every intraday swing, eagerly awaiting the market open and agonising over the close, take a step back and reflect on whether that’s a productive use of your mental energy. While keeping on the pulse of the current climate is important, it can be easy to let this barrage of unpredictability cloud your judgement. Again, Carl Richards illustrates it best below:

3. Speak To Your Adviser

Who better than your financial adviser to offer an experienced, impartial and rational assessment of your finances in times of crisis? A trusted second opinion can be an invaluable voice of reason.

At Altus, we understand that these volatile times are distressing in many ways. Not only are we all trying to manage financial uncertainty, but also comprehending incredible social changes that affect the daily lives of our families.

But one thing hasn’t changed; disciplined financial decision making remains the best course of action.

.svg)

.svg)

.svg)

.svg)

.svg)