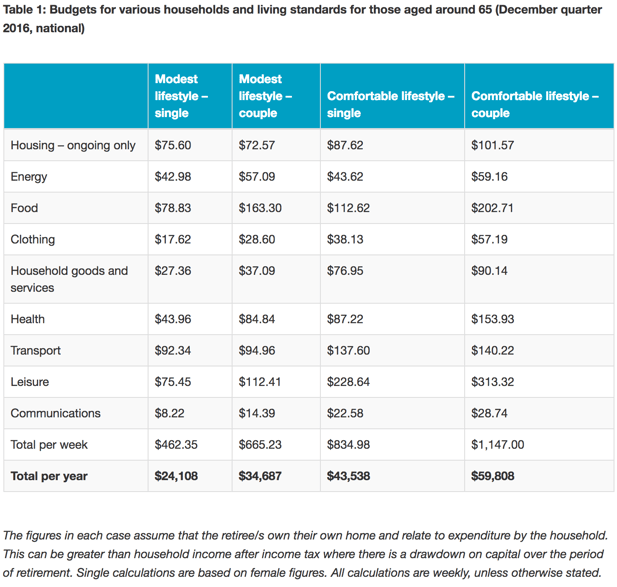

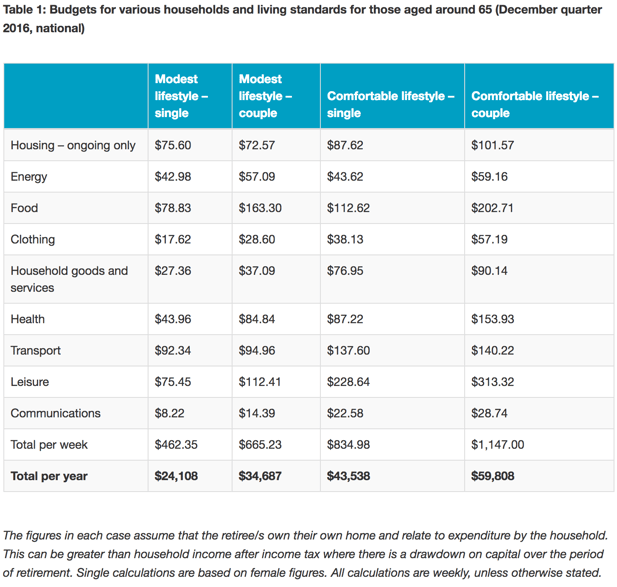

The ASFA Retirement Standard figures offer a useful starting point in determining the amount of money you will need to retire according to your lifestyle goals. According to figures released in the December quarter, 2016, the national averages are;

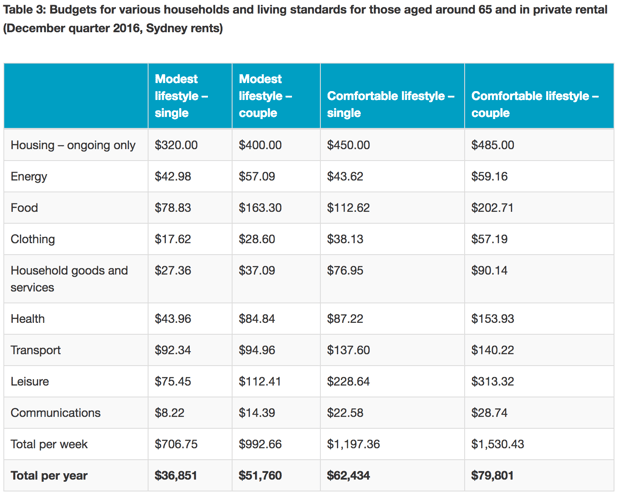

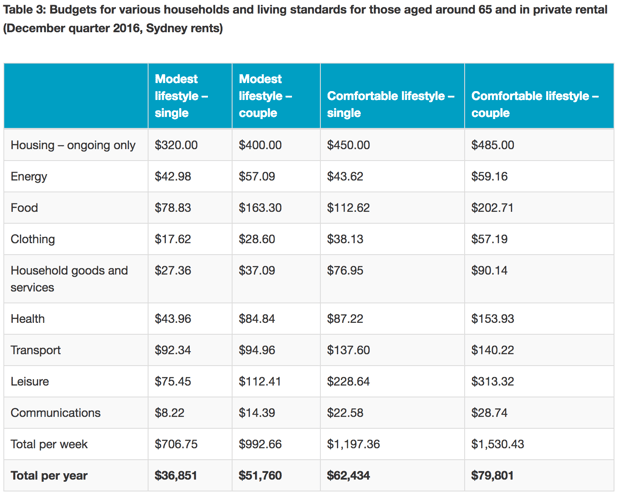

These figures from the Association of Superannuation Funds of Australia are significantly higher for Australians who do not own their own home;

Retiring With Debt

An increasing number of Australians are retiring with unpaid debts. Paying off your debts before retirement is an obvious ideal, however isn't always possible. If you don’t, you’ll need to add debt repayments to your retirement expenses or take a lump sum out of your super to pay off your debts. Either way, your retirement savings won’t go as far.

Personalisation of Your Retirement Plan

Once you’ve determined your ballpark retirement figure and have considered any debts you need to pay, it’s time to think about personalising your retirement plan. Do you plan on staying in your current home or moving to a place with lower housing costs? Do you plan on pursuing new interests that require additional funds?

It’s a good idea to meet with an adviser to help you put together all the pieces of your retirement plan. The real cost of living in retirement differs from person to person, and expert advice can be enormously helpful in determining yours.

Building Your Retirement Plan

Once you have reached a target amount to save for retirement, you need a plan. This may include salary sacrifices to increase the amount of money you save each month. Salary sacrificing may be helpful to your current financial state as well as your long term retirement plans because of the tax savings involved.

Face the future head on by finding out your real cost of living in retirement, then make a plan and put it into action.

Aged Care Finances: What Does it Really Cost?

Getting old can be a challenge in many ways. But for all the challenges of advanced age, there are also great benefits, like the kind of wisdom that only comes through life experience.

As you prepare for the next stage in ageing and aged care, ensure you discuss the various costs with your family and how you plan to pay for them.

This short video explains the fundamentals of aged care costs:

The fees you’ll pay for aged care are divided into the following four categories:

1. Accommodation Deposit

This fee is set by the aged care facility, and it is published on websites and in other literature from the facility. As you look at accommodation payment fees, remember you can pay this by either a lump sum like the Refundable Accommodation Deposit (RAD) or daily fee (DAP), or a combination of these.

2. Basic Daily Care Fee

Once you require daily care (either in your own home or a residential care centre), you will be charged a daily fee. Like the Accommodation Payment, the Basic Daily Care Fee is paid by all aged care home residents at a fixed amount, regardless of their assets or income. This fee is indexed in March and September every year.

For those entering aged care or acquiring home care after 20 March 2016, the maximum basic daily fee is $9,931 for home care and $48,251 for residential care. Providers cannot charge more than this for the basic daily care fee, but there will be other fees to pay in most cases.

3. Income-Tested Fee (Means-Tested Fee)

In addition to the basic daily care fee, you may be asked to pay an income-tested fee (for home care) or a means-tested fee (for residential care). The Australian Government sets the amount that you must pay directly to your aged care provider; the care subsidies paid to the provider are reduced by the same amount.

Currently, this fee is capped at $25,939.922 a year, but you won’t have to pay more than $62,255.852 over your lifetime.

4. Additional Services Fee

Facilities often offer extra services above and beyond basic daily care, and they can charge an Additional Services Fee to cover these services. This fee usually ranges from $20 - $120 per day, depending on the services and the aged care facility.

With this information, you can come up with a ballpark figure for how much your aged care will cost. You’ll find as you research different facilities’ websites that there is a range of accommodation payment fees, and you can tailor your aged care expenses to your budget by choosing a facility that best meets your needs and income.

Other Considerations

- You don’t have to make your accommodation payment before you move into an aged care facility. However, you do have to agree on the amount you will pay and sign the facility’s Resident Agreement.

- The refundable accommodation deposit (RAD) is held in trust for you by the residential service provider. The money can be invested to earn interest or used to buy land or expand operations, or it can be used to pay for maintenance. You can think of RAD as an interest-free loan to the aged care service; it is not repayable until you leave.

- Take extra care when researching aged care facilities in Victoria or South Australia. Some facilities in these states are funded and regulated by the State Government, and they don’t guarantee repayment of RAD.

- Seek advice on how to restructure your investments to plan for aged care. There may be strategies you can use to increase your Age Pension in order to make sure you have enough cash flow to pay for aged care services.

Here is a short video on other aged care considerations:

Means Testing: What You Need to Know

Through your research of aged care and retirement planning, you’ll likely come across the phrase “means testing.” Means tests help to determine your eligibility for certain government benefits. Understanding means testing and how it applies to you can help you with your financial planning, and help you to know if you’re receiving all the benefits for which you qualify.

What is Means Testing?

Means testing is a process to test your income levels to see if you qualify for government benefits. Means testing may also determine what level of benefit you receive or whether or not you qualify for a rebate. For instance, for the Private Health Insurance Rebate, if your income surpasses the defined tiers, your rebate will be reduced or even halted.

Means Testing for Pensions

The Department of Human Services’ means test evaluates eligibility based on:

- Gross employment income, including wages, salaries, bonuses, commissions, stipends, and overtime

- Income from financial investments, including money in your superannuation account if you have reached the pension age

- Business income, including farming income

- Dividends and distributions from private companies and private trusts

- Income from real estate, including rents from investment properties

- Some superannuation contributions

- Income from outside Australia

For Department of Human Services pensions, your pension will drop to $0 if your income is high enough.

Aged Pension Assets Test

The Age Pension Assets test compares the value of your assets to set asset thresholds that determine if you are eligible for the Age Pension and other benefits. The criteria for this test is updated each March and September, so keep an eye on changes to your own personal benefits.

Financial circumstances can change, and markets are certainly always changing. Ensure you regularly check your means testing to see if you qualify for benefits that you’re entitled to.

If you are unsure, check with your financial adviser to see if you qualify for full or part benefits.

Do I Lose My Super Going into Aged Care?

Residents of aged care must pay an accommodation payment when they first move into an aged care facility. This accommodation payment can be a large amount of money. But will the aged care accommodation payment and the ongoing costs associated with your care cause you to lose your entire super?

Your Superannuation Options in Aged Care

There are many elements that can determine if you’ll retain some of your superannuation upon entering aged care. Traditionally, many Australians have sold their homes in order to pay for aged care. That way they would then keep their pensions to cover ongoing fees associated with their care. This formula may still work for some, but it’s not a certainty like it used to be.

Depending on the value of your home, it might be sensible to hold onto it and use it for rental cash flow, which can continue to pay for ongoing aged care expenses. If rental income can cover your aged care accommodation payments, holding onto the property can be a wise financial move. If, however, rent falls far short of your accommodation payment, it might make more sense to sell it and use the proceeds to pay for your accommodation payment or your ongoing expenses.

When One Member of a Couple Moves to Aged Care

When a couple is living on the age pension and one of them needs to move into aged care, the remaining spouse can stay at home and continue living on the pension. If they fall under the means test, half of the couple’s combined income and assets will be assessed.

If a couple has enough in their super account, they may be able to pay the aged care accommodation payment for one of them out of a lump sum from their super while continuing to pay for home expenses for the remaining spouse out of income from the super or their pension.

Planning For Aged Care

When the time comes to moving into aged care, here are some steps the family should work through:

1. Find an aged care facility that offers the right standard of care, suits your budget, and is in a convenient location for the family.

2. Do the numbers. Find out how much your accommodation costs would be, and calculate the other expenses associated with aged care. For people on a full age pension, 85% of the pension goes toward the aged care facility’s basic daily fee. All others face means testing.

3. Decide whether or not you will keep your house. Again, a suggestion is to calculate whether or not rental income would cover ongoing expenses like your accommodation payment.

4. Work through your financial options. It’s best to seek advice from an independent financial planner who has experience helping people with aged care. Don’t rely on the staff at the aged care facility to help you work through your finances.

Whether you lose all of your super going into aged care or not depends on how much you’ve saved and how much your aged care will cost. If you need further guidance to work through your personal finances in preparation for aged care, get in touch and we can guide you through this.

Is One Aged Care Option Financially Better Than Another?

Is one aged care option financially better than another? Is there a way to make your savings stretch further when it comes to aged care?

There isn’t a one-size-fits-all answer to this question. However, evaluating different options can help you find the best strategy for you and your family.

Living With Family

Many older Australians are living with family as they age. It can be satisfying for family to spend this time together, and living with family often means that you can stay close to the people you love. Living with family can have its challenges, however. It can put a lot of pressure on the caregivers because they’re constantly on call. If there’s someone in your family who wouldn’t have to quit a job in order to care for you, this can be a very affordable option.

Respite Care

Sometimes, family members are temporarily unable to care for you and you many need some short term care to get you through a health issue or need some extra help. In this instance, respite may be the best option for you. Respite care may allow you to continue living independently by helping you through a short-term difficulty.

Home Care

Home care is now more of a possibility due to more and more resources being available for many older Australians. Home care is appealing because you can stay in your own home, which may be close by to your friends, your neighbours, and your family.

The costs for home care can vary, depending on what kinds of services you need.You need to consider the costs of delivered meals, shopping services, private care, medical alarms, equipment for your home, and transportation.

Certain services are funded under Help At Home: personal care like dressing, showering, and mobility; house tidying and cleaning, clothing washing, and meal preparation. Other services that are not currently funded include companionship, live-in care, and sleepovers.

Tapping Into Your Home Equity

For most of us, the value of your home is a large component of our wealth. That’s usually the case for many older Australians, so it’s natural to look to your home as a source of income for paying for aged care.

In 2016, the government eliminated an exemption that allows rental income to be excluded from means testing.

These are big changes: the family home has been exempt from means testing for the age pension for over 100 years in Australia. This change may mean that more and more Australians sell their homes to pay for aged care. This might be a good option for you if you don’t have enough savings left to pay for aged care and you have substantial equity in your home.

Superannuation and Savings

If you have sufficient funds in your superannuation and savings to cover the costs of your aged care, you won’t need to tap into your home equity. Consult with your financial adviser to discuss the state of your super and whether or not it will cover your expectations for aged care.

Finding Professional Aged Care Advice

Preparing your finances for aged care can be a complex process, and one that greatly benefits from professional advice. At Altus, we're experienced in helping Australians prepare for the costs associated with aged care, and have a 6-step preparation process, explained in this video:

To discuss how we can help you prepare for the costs of aged care, get in touch with us today.

.svg)

.svg)

.svg)

.svg)

.svg)